Increasing our renewables capacity must be balanced with more energy storage – all while keeping an eye on the GHG emissions footprint

- Post Date

- 20 March 2023

- Read Time

- 3 minutes

Over the past five years we’ve seen a steady increase in renewable energy generation feeding into Australia’s electricity system. The maximum renewable contribution (30min measurement intervals) within the National Electricity Market (NEM) has increased from 30.2% in January 2018 to 64.0% in January 2023, resulting in a lower average carbon emissions intensity of the electricity we consume. That’s good news. However, there is still a lot more work we need to do.

Maximum Renewable Penetration Over Time – Jan 2018 to Jan 2023

Source: AEMO January 2023

As more renewable energy resources are connected to our grid over the next few years, it will become increasingly more important to also add sufficient energy storage resources so that we:

- avoid excessive curtailment (i.e., unwanted dumping) of renewable energy generation,

- avoid grid instability issues, and

- continue our path towards decarbonisation of Australia’s electricity system.

One of the leading energy storage solutions for utility-scale short duration applications continues to be lithium-ion (Li-ion) battery energy storage systems (BESS). This is due in part to manufacturing capacity increases and more market competition driving a downward trend on BESS capital cost. As we kick off the new year, the SLR Consulting team is seeing a significant increase in demand for our planning and environmental/social impact services related to Li-ion BESS projects across the APAC region. Our team plays a lead role from the early risk assessment screening stages through to planning, permitting, approval and construction monitoring.

When developing one of these projects, one of the key things to consider is the BESS equipment’s carbon footprint, mainly to verify that it doesn’t inadvertently increase our electricity system’s carbon emissions intensity. We’re seeing evidence of this through an increased focus in the market on understanding the Scope 3 (i.e., supply chain) GHG emissions. With this in mind, conducting a GHG life cycle assessment (LCA) on Li-ion BESS, in accordance with the GHG Protocol for Product Lifecycles, is one of the services SLR may provide within a holistic ESG data management service. Clearly and concisely reporting this type of evidence-based data helps our clients demonstrate their continued path to net zero.

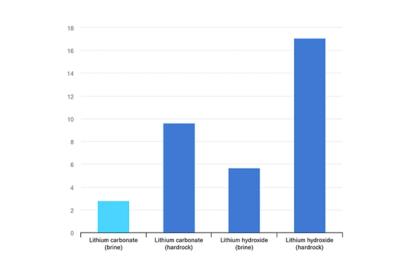

Conducting a thorough LCA for a Li-ion BESS involves taking a deep dive into the supply chain, which for example, may involve verifying where the battery manufacturer is sourcing their lithium from. In the chart below you can see there’s a big difference in the GHG emissions intensity between lithium derived from brine and hardrock. Lithium derived from brine has the advantage of having a much lower carbon emissions intensity. However, when balanced into assessing all the other environmental impacts within the scope of an LCA, understanding which results in least impact from a BESS supply chain perspective can lead us to a different conclusion.

GHG emissions intensity for lithium by resource type and processing route (t CO2 per tonne Lithium Carbonate-equivalent)

Source: IEA, Pari

The GHG emissions intensity of the raw lithium is just one of many data points our team will collect to fully understand the Scope 3 emissions of a project’s BESS equipment and all the other environmental impacts. At the other end of the BESS life cycle, the emissions intensity of its recycling and raw material recovery processes are also significant contributors which need to be quantified – sometimes twice over. This is because BESS modules typically only last 10-12 years in a utility-scale installation, which means their replacement often falls within the project’s life cycle defined by its energy storage contract term. Furthermore, if the lithium is not recycled, it may be necessary to double the mined lithium GHG emissions intensity in the assessment. It demonstrates the need to investigate a project’s GHG emissions footprint from all angles when quantifying the Scope 3 emissions. Every GHG emissions contribution counts.

Recent posts

-

-

-

Transforming the Food & Beverage industry: From compliance only to business-driven decarbonisation

by Vincenzo Giordano, Joseph Payne, Stéphane Rapoport

View post