JORC Code update: Explaining the changes for mineral companies

- Post Date

- 14 August 2024

- Read Time

- 5 minutes

At a glance:

The JORC updates aim to enhance transparency, incorporate ESG considerations, and improve the reporting of mineral resources and reserves, leading to greater confidence the industry.

The world’s most popular resource and reserve reporting system has released a long-awaited draft update, twelve years after the 2012 edition. The Australian Joint Ore Reserves Committee (JORC) launched the exposure draft of their ‘Australasian Code for Reporting of Exploration Targets, Exploration Results, Mineral Resources, and Ore Reserves’ (the JORC Code) for public consultation in August 2024. Drafting the update has taken an extended period of time due to the number of stakeholders involved, including the Australia Stock Exchange (ASX) and the Australia Securities and Investment Commission (ASIC), along with the Australian Institute of Mining and Metallurgy (AusIMM), exploration and mining companies.

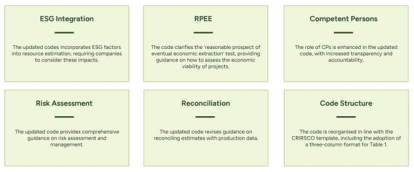

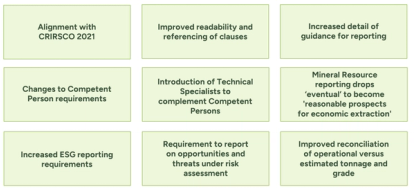

The new document has been drafted following assessment of an external online survey in 2020 and to reflect changes to the minerals and mining sphere since 2012. This includes alignment with the reporting template produced by the umbrella reporting organisation, the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) along with ensuring recent trends – particularly with respect to environmental, social and governance (ESG) - are accounted for. A summary of the key changes from 2012 to 2024 is presented below:

Although there are a number of changes throughout the Code, the purpose of the document remains the same: to ensure mineral companies reporting exploration results, resource and reserve estimates are reporting using the three main principles of transparency, materiality and competence.

What does the JORC Code update mean for minerals and mining companies?

As well as providing welcomed clarity for certain aspects and easier general navigation, there are some key changes in the update. Notably, the introduction of Specialists to assist Competent Persons with reporting. Although the Competent Person(s) will remain the main signatory of all public documents using the JORC Code to report against, they now have more structured guidance on how to make use of other technical specialists (also referred to as subject matter experts, SME) where a subject lies outside their field of expertise. This would include roles such as metallurgists, geotechnical engineers, hydrogeologists and ESG specialists.

The increased transparency of ESG issues reflects the recent focus of stakeholders across the board from investors, lenders, consumers, regulators and the public. There is a greater emphasis on ensuring negative impacts associated with minerals and mining projects are assessed at the earliest possible stage with mitigations in place to either avoid and minimise impacts where possible and restore and offset where not possible. Increased transparency in reporting aims to provide potential investors with a complete understanding of the risks to have a well-informed decision.

Although it might seem arbitrary, the removal of the first E from RPEEE (reasonable prospects for eventual economic extraction) to RPEE is significant. In the past, it could give Competent Persons free reign to use pie-in-the-sky economic parameters when assessing the financial prospectivity of the mineral deposit and pushes non-geological considerations to a later stage. Removal of ‘eventual’ brings the mineral resource into the present day. Some may argue it blurs the line with reporting of reserves; however, the fundamental distinction remains, demonstrating technical and economic viability through detailed technical studies to at least a Prefeasibility Study (PFS) level of study. Through considering RPEE, the new Code requires that the Competent Person should assess modifying factors throughout the lifecycle of a project and not just at the reserve reporting stage. This links to the requirement to consider ESG in more depth and at an earlier stage of project development; a key consideration for all stakeholders.

In summary, the draft JORC update brings substantial changes, including ESG considerations, enhanced transparency, and requiring Specialists to assist Competent Persons with the increased reporting expectations.

What can SLR offer to minerals and mining companies?

SLR’s Mining Advisory team can assist minerals and mining companies, with assistance from related technical specialist areas within the SLR Group. This includes:

Technical Expertise:

- SLR's geologists, engineers, and technical specialists can provide technical assessments, verify data, and ensure compliance with JORC standards.

- We offer tailored solutions for exploration planning, resource and reserve estimates, and operational assistance, along with review and due diligence work.

Experience:

- SLR has huge experience across the minerals and mining industry. Our consultants include technical specialists with operational experience across the spectrum of commodities.

- We bring that extensive combined experience and knowledge together in our One Team culture through collaborations across sectors and geographies.

ESG Integration:

- SLR's ESG consultants can guide companies in identifying relevant ESG factors, conducting impact assessments, and aligning reporting with global ESG frameworks.

- We help companies demonstrate their commitment to sustainability and responsible resource management. The wider SLR Group includes the ESG advisory team with significant experience in corporate governance including disclosures, reporting and ESG strategy.

Recent posts

-

-

Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post -