Australian Sustainability Reporting Standards (ASRS) - How to ensure a complete and robust value chain emissions inventory

- Post Date

- 04 September 2023

- Read Time

- 6 minutes

As of September 2024, the final standard has been confirmed with a few changes since this article was published. Please see our latest article which steps through what you need to know.

In January 2024, the Treasury released an exposure draft legislation[1] to introduce mandatory requirements for organisations to disclose their climate-related risks and opportunities. Our factsheet provides an overview of the disclosure requirements, and the proposed mandates cover both public and private companies, requiring the rapid implementation of climate reporting aligned with international frameworks (TCFD[2], ISSB[3]).

To understand who has to comply and when, download our factsheet

The requirements are comprehensive and will require a step-change in climate reporting for many Australian businesses. There are four key areas of disclosure which we think will be the most challenging for companies to address:

In this blog we will take a closer look into the first topic, Scope 3.

What does the draft standard mention on Scope 3 requirements?

The draft standard proposes:

“The entity shall consider its entire value chain (upstream and downstream) and identify and disclose the categories it has included in its Scope 3 greenhouse gas emissions disclosures.”

The AASB also suggests reporting entities to include and consider the 15 scope 3 emission categories aligned to the GHG Protocol Standards. The recent updates from AASB have suggested that entities will have to disclose scope 3 emissions against the 15 categories of upstream and downstream emissions aligned to the GHG Protocol. Furthermore, the standards also proposed that entities participating in asset management, commercial banking and insurance activities will need to consider additional disclosures related to its financed emissions.

Reporting entities are also expected to disclose information about the measurement approach, inputs, and assumptions used to calculate its Scope 3 emissions, and clearly outlining how the entity has prioritised highest quality data was utilised during the reporting period.

The AASB anticipates that initial Scope 3 disclosures would be based on available information and represent estimates. As companies become more adept at estimating Scope 3 emissions and data quality improves, the quality of disclosures is expected to increase. Furthermore, the AASB mentions that Scope 3 disclosures can pertain to any one-year period preceding the current reporting period. This acknowledges that, particularly concerning financed emissions, reporting entities might rely on emissions data from other entities.

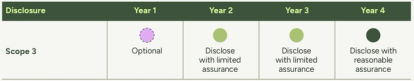

When do you have to start disclosing Scope 3 emissions?

In our factsheet, we discussed about the categorisation of all incorporated companies in Australia to three distinct groups for reporting purposes. To be included in a particular group, companies must meet at least two out of three size criteria related to employees, consolidated gross assets, and consolidated revenue. Additionally, any company already required to report under the National Greenhouse and Energy Reporting (NGER) Act 2007 (Cth) will be captured irrespective of size.

The first companies will start disclosures from FY24/25, with scope 3 mandatory from FY25/26.

Regardless of initial disclosure year, each company will follow the same sequential reporting and assurance requirements. Companies are expected to report with full, reasonable assured disclosures from the fourth year onwards.

What are the implications of these mandates?

It is clear from the consultation paper these mandates will require a large number of businesses to rapidly improve their climate reporting.

From a scope 3 perspective, organisations will have to start a journey towards the development of a robust emissions inventory that could be externally assured and verified. Many companies are currently only reporting where they have easily accessible data, if they are reporting at all, the requirement to report all material emissions will mean it is essential to start gathering more comprehensive data and calculate a complete footprint.

There are a few key elements companies need to consider:

- Relevancy: Decide focus areas and unpack the complexities across your organisation’s value chain activities, an initial screening would be required to develop a high-level inventory in line with international guidance such as the GHG Protocol.

- Completion: Convert your activity data from value chain activities into an emissions inventory using globally recognised emissions calculation methodologies. It's essential to have a clear understanding of your overall Scope 3 emissions inventory to assess your environmental impact. This may involve significant estimations and assumptions in the first years, but this will help companies identify priority areas to focus data improvements.

- Continuous improvement: Companies must work towards complete and auditable data sets, that can stand up to the same level of scrutiny as their financial data. Companies will need to be actively working with suppliers & customers to obtain higher-quality data sets, thus enhancing your Scope 3 inventory for reasonable assurance and verification in line with the proposed mandates.

How can SLR support you?

We understand that every company is at different levels of maturity in terms of scope 3 inventory development. However, our team brings together a wealth of local and global expertise in supporting organisations to calculate, communicate and ultimately manage scope 3 (value chain emissions). Our 4-stage approach that SLR can support you with includes:

- Relevance: Support and understand Scope 3 categories that are relevant and material for your company.

- Materiality: Estimate emissions for each of relevant categories and determine which require more in-depth analysis.

- Refinement: For relevant categories, SLR will identify potential improvements to data and calculations to ensure robustness.

- Roadmap: Consolidated findings and report on next steps to continually improve data fidelity and ensure actionable outputs.

Webinar

We held a webinar covering the key aspects of the disclosures, case studies of best practice and practical guidance on where companies can begin addressing the requirements.

For those that were unable to attend, you can view the recording at the link below. This webinar is relevant for all companies who will be required to report, whether experienced in their disclosures or facing this for the first time.

Contact James or Luke for further information.

Recent posts

-

-

Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post -