Australian Sustainability Reporting Standards (ASRS) - Transition Planning: Navigating the Path to a Low-Carbon Future

- Post Date

- 12 October 2023

- Read Time

- 9 minutes

As of September 2024, the final standard has been confirmed with a few changes since this article was published. Please see our latest article which steps through what you need to know.

In January 2024, the Treasury released an exposure draft legislation[1] to introduce mandatory requirements for organisations to disclose their climate-related risks and opportunities. Our factsheet provides an overview of the disclosure requirements, and the proposed mandates cover both public and private companies, requiring the rapid implementation of climate reporting aligned with international frameworks (TCFD[2], ISSB[3]).

To understand who has to comply and when, download our factsheet

The requirements are comprehensive and will require a step-change in climate reporting for many Australian businesses. There are four key areas of disclosure which we think will be the most challenging for companies to address:

- Scope 3;

- Climate Scenario Analysis;

- Transition Planning, and

- Assurance Readiness.

In this blog we will take a closer look at the transition planning requirements proposed in the ASRS exposure draft.

What is transition planning?

A climate-related transition plan, as defined by the IFRS S2 Standard is:

“an aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.”[4]

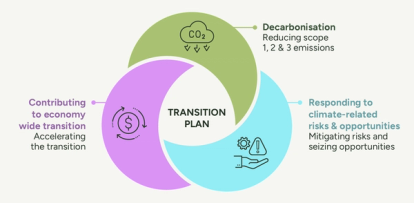

In essence, transition planning is a strategic process designed to not only guide businesses in aligning their value chain with a low-carbon, sustainable future, but also to contribute to an economy-wide transition more broadly. In October 2023, the UK’s Transition Plan Taskforce (TPT) released its first Disclosure Framework[5], setting a gold standard framework for climate transition plans, where they highlights the importance of this multifaceted approach to climate-related transition plans.

A transition plan should contain three main elements:

- Decarbonisation: targets and emissions reduction strategies, across scope 1, 2 & 3

- Response to climate-related risk and opportunities: How to mitigate emerging physical and transitional risks, as well as realising the opportunities in the transition.

- Contribution to economy wide transition: How the companies business model aligns with global goals, and accelerates emissions reductions in the wider economy.

Transition planning is the bridge between setting ambitious climate goals and taking tangible near-term actions to achieve them. Without robust transition plans, companies struggle to align with a net-zero world. Furthermore, when developing a climate-related transition plan, it is important to align with a just transition[6] by considering the far reaching impacts that the rapid transition will have on communities around the world and work to mitigate the negative impacts of the change on vulnerable populations.

Transition plans provide a framework for companies to outline their strategies and share key details with stakeholders, including investors, governments and the public. Transition plans include:

- Setting ambitious climate targets aligning operations with limiting global temperature rise to 1.5°C.

- Setting Scope 3 value chain targets that align with a 1.5°C world.

- Defining actions and initiatives necessary to achieve these goals, considering the evolution of emissions over time and business growth.

- Establishing governance mechanisms to ensure accountability in delivering transition plans and achieving climate goals.

Transition planning is not merely a regulatory necessity but a strategic imperative. Robust and credible transition plans are essential to achieving net-zero goals, fostering transparency, and enabling informed decision-making by investors and stakeholders.

What does the draft standard mention about transition planning requirements?

The draft ASRS standard defines a transition plan as:

“An aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.”

From commencement, transition plans would need to be disclosed, including:

- Key assumptions used in developing the plan, and dependencies on which the entity's plan relies

- Climate related targets, including any GHG emissions targets,

- Information on resourcing, and plans to resource the transition plan,

- Effects of climate-related risks and opportunities on climate-related transition plans.

- Quantitative and qualitative information about the progress of the plans disclosed in previous reporting period.

This indicates that from the very beginning of ASRS implementation, companies will be required to disclose their transition plans. The climate-related transition plans need to clearly articulate how an entity plans to decarbonise with clear climate related targets, resource planning to achieve the targets, as well as progress to date.

When do you have to start disclosing transition plans?

The first companies will be required to disclose from FY24/25, although smaller entities will have 2-3 years longer to prepare. Regardless of initial disclosure year, each company will follow the same sequential reporting and assurance requirements including:

- Disclosure of a climate transition plan in the first year

- Disclosure with limited assurance by the second year

- Disclosure with reasonable assurance by the end state, which is expected to be the fourth year of reporting.

Where should companies start on developing their transition plan disclosures?

The standard’s focus on transition planning is a significant step towards integrating this concept into regular corporate reporting. It places pressure on companies to develop credible and robust plans that address the risks and opportunities associated with decarbonisation.

While the draft standard sets the stage for transition planning, it also opens the door to an important discussion on the specifics of these plans. As the consultation does not adequately outline the specific expectations on entity transition plan disclosures, we suggest that alignment with the UK’s new TPT Disclosure Framework is a good place to start[5]. This gold standard framework for transition planning outlines how companies should approach their transition planning disclosures and is explicitly aligning with relevant frameworks[7] ssuch as ISSB.

The framework further guides companies’ transition planning disclosures via five critical elements:

- Foundation: The fundamental principles and objectives behind the transition plan.

- Implementation Strategy: A clear strategy for executing the plan, including the actions and initiatives to be undertaken.

- Engagement Strategy: How the company plans to engage with stakeholders, investors, and communities during the transition.

- Metrics and Targets: Clear metrics and targets that define the company's progress toward its climate goals.

- Governance: The governance mechanisms in place to ensure accountability and effective implementation of the plan.

In essence, the aim here is that transition planning becomes a foundational element of climate reporting right from the start. Further to this, limited assurance of these climate transition plans is expected in the second year of reporting, increasing to reasonable assurance by end state. This necessitates a high level of rigor from organizations when it comes to the data integrated into the plan.

Companies will be expected to capture both implemented and planned initiatives, including:

- GHG emissions footprint: This data is the starting point for understanding the current impact and setting the stage for emissions reduction.

- Science aligned GHG emissions reduction targets (e.g., SBTi): Clearly defined targets, in line with established scientific standards like SBTi, are essential for guiding the reduction efforts and ensuring alignment with global climate goals.

- Detailed decarbonisation actions: Transition plans must include a detailed strategy for decarbonization. This means outlining specific actions and initiatives aimed at reducing emissions and transitioning to a low-carbon model.

- Alignment with climate risks and opportunities identified during the climate scenario analysis: The transition plan should explicitly address the risks and opportunities revealed through climate scenario analysis. It's about understanding how decarbonization efforts fit within the broader context of climate-related challenges and possibilities.

- Collation of this information including governance mechanisms into a coherent climate transition plan: All of these elements, from emissions data to economy wide decarbonization actions and company specific risk considerations, need to be organized into a cohesive and structured climate transition plan.

How can SLR support you?

Our team at SLR brings together a wealth of local and global expertise in supporting organisations in all stages of transition planning, including:

- Calculating and communicating scope 1 & 2 operational emissions

- Evaluating and disclosing scope 3 value chain emissions

- Setting science aligned emissions reduction targets for full value chain emissions.

- Developing decarbonisation pathways and net zero strategy to align companies with global goals, including the rapid near-term emissions reductions, long-term deep decarbonisation of the business model, and utilisation of carbon removals for any residual emissions

- Assessing and quantifying the financial impact of both physical and transition climate impacts and integrating these risks and opportunities into company enterprise risk- management framework

- Collation and integration of this information into a cohesive and coherent climate transition plan, including assistance with disclosure and reporting, as well as internal engagement.

Webinar

We held a webinar covering the key aspects of the disclosures, case studies of best practice and practical guidance on where companies can begin addressing the requirements.

For those that were unable to attend, you can view the recording at the link below. This webinar is relevant for all companies who will be required to report, whether experienced in their disclosures or facing this for the first time.

Contact James, Luke, or Ashleigh for further information.

[1] Mandatory climate-related financial disclosures

[5] https://transitiontaskforce.net/wp-content/uploads/2023/10/TPT_Disclosure-framework-2023.pdf

[6] https://www.slrconsulting.com/insights/enabling-a-just-transition/

Recent posts

-

-

Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post -