Natural capital and the environmental drivers for business

- Post Date

- 24 January 2023

- Read Time

- 7 minutes

Nature is no longer a peripheral concern for business - it’s a core driver of value, risk, and resilience. This article explores how natural capital (the world’s stock of natural assets including soil, air, water, and biodiversity) is becoming central to corporate strategy. As environmental pressures intensify, businesses must understand their dependencies and impacts on ecosystems to remain competitive and future-fit. From regulatory shifts to investor expectations, the drivers are clear: integrating natural capital into decision-making is essential for long-term sustainability and success.

The environment has become an increasingly important topic for all businesses over the last two years, as there is more data that supports our understanding that we are depleting the earth’s resources in an unsustainable way. This is also partly influenced by COVID-19 and also the Attenborough and Thunberg effect. Extreme weather events and more recently commitments from the COP26 summit and the Environment Act receiving royal assent have all continued to drive the importance.

Previously there was an awareness of climate change, but many people didn’t expect that it would have an impact within their lifetime. Increasingly we are now seeing climate related impacts with extreme weather conditions globally together with wildlife and species in decline.

There are likely to be significant challenges ahead for all businesses related to climate change as well as business resilience and climate adaptation. In addition, there will be challenges associated with energy transition and decarbonisation. Businesses may have made net zero pledges and commitments at a corporate level, but what does it really mean for the operational parts of the business?

There’s a further fundamental impact that is becoming increasingly important for businesses to consider and that is the depletion of natural capital and ecosystem services and the benefits that these provide for human life.

The concept of natural capital isn’t new. The term was first used nearly 50 years ago. However, it is only in recent years that it has increased in prominence and been recognised as increasingly important in considering the real value that the environment has in business decision making.

Natural capital revolves around the concept that non-human life produces the goods and services that are essential for our survival.

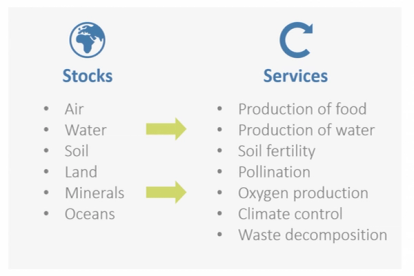

Figure 1: Natural Capital

In Figure 1, you can see that natural capital can be split into two key areas, these being stocks of our natural resources. These physical ‘stocks’ also provide flows of benefits called ‘ecosystem services’. These provide us, the population, with the means for healthy lives and underpin all economic activity.

However, we are using our natural resources in an unsustainable manner. We are depleting our natural resources in such a way that we’ve never seen before in human history.

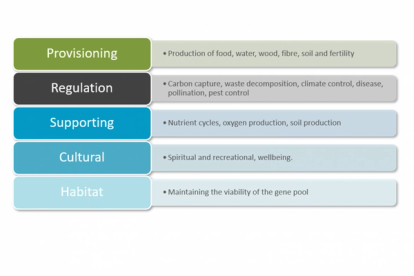

Figure 2 below lists the ecosystem services, for example Provisioning, which is the production of food, water, fibre, and soil etc. Interestingly there is also a ‘wellbeing’ aspect to benefits we derive from our natural resources.

Figure 2: Ecosystem Services

Looking at this from a business perspective, if you’re a business that doesn’t have large areas of undeveloped land as part of your business assets, the importance of natural capital may be less obvious. However, natural capital and your impact upon this is still a really important consideration and all businesses will need to understand their impacts and dependencies on natural capital in the future.

Halting and reversing the depletion of our natural capital, delivering nature based solutions and biodiversity net gain are at the heart of trying to limit climate change and achieving net zero. For all businesses the focus upon environmental performance is increasing and that’s being driven by a number of environmental drivers which are challenging for businesses. These are: climate risk and resilience, energy transition, circular economy and natural capital.

Climate risk and resilience

Climate risk and resilience is an important issue for all businesses. How are businesses going to protect their operations and assets from the impacts of climate change, extreme weather events, supply chain shortages or disruption? If you consider the climate impacts on assets, supply chain and businesses there is potential for a big financial impact.

Energy transition

How can businesses with fleets of diesel vehicles move to low carbon transport? How costly will this be to businesses? What will the supply chain impacts and associated costs be?

Circular economy and resource efficiency

How do businesses achieve circularity? And how do they achieve supply chain sustainability?

Natural capital

Previously natural capital and biodiversity was very much regarded as being separate from corporate reporting requirements. However, natural capital is now at the heart of the environmental drivers and is increasingly being seen as an integral part of these as well as being introduced to corporate reporting.

The World Economic Forum’s annual global risk report in 2021 found that the top three risks by severity over the next ten years are all environmental: climate action failure, extreme weather and biodiversity loss. Figure 3 below demonstrates that there is a wide range of increasing environmental drivers from corporate reporting such as TCFD, to new legislation such as the Environment Act, to understanding the business risks associated with declining biodiversity and natural capital.

Figure 3: Environmental Drivers

If your business measures and reports through Carbon Disclosure Project, from this year (2022) that reporting will include a module on biodiversity. Businesses will have to provide details of board-level oversight of biodiversity related issues in addition to details of the impact of the value chain on biodiversity and report on actions to progress biodiversity related commitments, and for many businesses this will be a real challenge.

Environmental and Social Governance (ESG)

Increasingly, investors are using ESG reporting to understand a business’ environmental impact and performance, and businesses are now using a natural capital approach to create a ‘baseline’ of environmental impact and more importantly identify how to reduce it. Environmental performance is increasingly becoming important to investors.

Taskforce for Climate Related Financial Disclosure (TCFD)

At present, this is voluntary. However, from April 2022 it will be mandatory for very large businesses.

Taskforce on Nature Related Financial Disclosures (TNFD)

The TNFD will have a similar impact to the TCFD, but from the perspective of nature and biodiversity. The beta framework for TNFD has recently been released.

Science Based Target Network

More businesses are signing up to the Science Based Target Network, and the criteria for science based targets is tightening. Businesses will have to create action plans for the short and medium term. The Science Based Targets Network is an expansion of climate-related reporting and targets to broader nature-related disclosures and strategy.

What about the challenges for those companies who are part of the supply chain? You may not be reporting to Science Based Targets, however, if your customer is then they’ll increasingly be looking to their supply chain to have carbon reduction plans in place and to report emissions.

The environmental landscape is changing rapidly and businesses are having to get to grips with a wide range of issues and reporting requirements. Those that embrace this early and take proactive steps will definitely be in an advantageous position. Much of this is emerging and there is often not a ‘right’ way to do this or a one size fits all approach. Often the starting point is starting to establish a baseline data. This will not always be straight forward but this can be improved and refined over time. Those business that don’t start to understand their impacts and dependencies are likely to face increasingly greater challenges as their competitors start to see the advantages of being on top of this.

If you would like help to understand how this relates to your business, please contact us.

Recent posts

-

-

Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post -