The essential role of the business sector in Ecosystem Protection

- Post Date

- 09 December 2024

- Read Time

- 4 minutes

What is the Role of the Business Sector in Ecosystem Protection?

Corporations and financial institutions are extraordinary inventions. ‘Shareholder primacy’ is an invention of the more ordinary variety, altogether too simplistic for our time of interconnected nature, climate, inequality, and other crises. Short-term financial imperatives and the exclusion of nature from traditional economic models mean that our planet’s life support systems have essentially been ignored by corporations and the aspects of nature that we rely upon have been considered infinite and ‘free’. Political expediency means that our leaders cannot often enough lead in this realm.

But what if the interaction with nature was not considered an impediment to businesses? Where historically there was safety in ignorance, there is now only exposure to risk and a failure to consider opportunities.

How the Taskforce on Nature Related Financial Disclosures (TNFD) guidelines and approaches are here to support businesses.

Guidelines published by the TNFD present simple steps to making our interactions with nature observable. All companies have dependencies (fresh water, pollination or healthy soil) and impacts (land use and pollution) on nature. For these impacts and dependencies, the TNFD approach can help us understand responsibilities across corporations’ value chains and across financial institutions’ portfolios. The TNFD approach can help us to change paths.

Over the last year we have seen many organisations test the TNFD guidelines and approaches, through integrating them into annual sustainability reporting or producing a stand-alone report. Along this journey, companies have realised that there is no net zero without nature and although there are potential risks associated with nature, opportunities exist for those that understand and act on the nature-related components within their business.

The fantastic thing about the TNFD is that these are foundations that can be built on over time, and an examination of nature-related interactions don’t need to be overly complex to begin with. Completing a rudimentary initial assessment now as a conscious decision to better integrate nature into future corporate governance and strategy is commendable.

Those with a voice in the Board Room have immense influence to help solve the global crisis: nature is very likely a material ESG impact issue (and a material risk issue) for your organisation even if in the past it has felt too abstract to be deemed as such. Shareholders, employees, and consumers also have ample influence to contribute to solutions, and humanity can push for much better.

The COP16 TNFD voice

The TNFD recently announced at COP16 in Cali, Columbia that there are 502 companies and financial institutions committed to getting started with the voluntary reporting, representing a 57% increase since the first formal announcement in January 2024. This update shows the rapid progression of the TNFD standards, following on from now mandatory reporting frameworks such as TCFD. Some notable recent adopters of the nature reporting framework include Qantas, Mitsubishi Electric Corp, Morrisons and Sainsbury’s, Manulife Investment Management and Jindal Stainless Limited; with 47% of adopters within Asia and the Pacific region.

How SLR can help

Understanding and reporting on biodiversity can be difficult, particularly as this is a rapidly changing and complex industry. We have designed our approach to help you not only navigate compliance but build your own internal capabilities from the outset. Our global team of nature experts have extensive experience supporting clients understand the nuance of the requirements and common pitfalls. Whether you are experienced in nature reporting or just getting started, SLR can support you at every step of the way.

Watch our recent webinar where we delve into the vital integration of nature-related reporting with climate reporting. Gain insights from experts, understand the importance of this dual approach, and obtain actionable recommendations on how to incorporate nature-related issues into your corporate reporting.

Watch WebinarTo learn more about Nature, Natural Capital and Biodiversity and how our experts are here to support businesses through implementing robust, science-based actions, visit our Nature, Natural Capital & Biodiversity service page.

To speak with one of our experts, contact Eoin or Dan today.

Recent posts

-

-

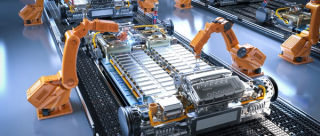

Driving down carbon in battery supply chains: Why it matters now

by Jasper Schrijvers , Ben Moens

View post -